I see many buyers confused by tumbler suppliers, pricing and quality differences. This creates doubt and delays decisions.

China has hundreds of tumbler factories, but only a small group offers stable quality, real certifications, and reliable lead times. The best choice depends on steel grade, vacuum testing, MOQ and your target market.

I want to help you make a confident sourcing decision.

What Makes a Tumbler Manufacturer a "Top Choice" in 2025?

Many buyers feel lost when comparing very similar claims from suppliers. This leads to risky decisions.

Top manufacturers show transparent QC, stable insulation, premium-grade materials, and real FDA or LFGB certifications. Buyers should check material, capacity, testing reports, and long-term defect rates.

Key Evaluation Factors

- Stainless steel grade

- Vacuum insulation life

- LFGB and FDA approval

- Production scale

- Automation level

- Defect control

Practical Comparison Table

| Factor | Budget Factories | Top-Tier Factories |

|---|---|---|

| Steel grade | Domestic 304 | Premium 304/316L |

| Vacuum life | Short | Long |

| Testing | Simple | Full |

| Certifications | Limited | Complete |

| Price | Lower | More cost-effective long-term |

How Are Stainless Steel Tumblers Actually Made?

Many buyers assume all tumblers are made the same. This causes unexpected quality problems.

Manufacturing steps include deep drawing, hydro-forming, welding, polishing, powder coating, and vacuum sealing. Each step affects shape, price, and durability.

Deep Drawing and Hydro-Forming

Deep drawing shapes metal1 by stretching. Hydro-forming uses water pressure2. Hydro-forming is more common because it gives stable cups and better cost.

Spinning

Spinning is slow and mainly for special shapes or small batches.

Which Stainless Steel Grade Should You Choose?

Some buyers think stainless steel is always the same. This causes corrosion and safety issues.

304 stainless steel is standard. 316L offers higher corrosion resistance and costs about 10–20% more.

Stainless Steel Comparison

| Grade | Resistance | Cost | Typical Use |

|---|---|---|---|

| 201 | Low | Cheap | Budget |

| 304 | Medium | Standard | Most tumblers |

| 316L | High | Higher | Premium brands |

The key difference lies in composition: 304 contains 18% chromium and 8% nickel, while 316L adds 2% molybdenum3 for enhanced resistance to chlorides and acids.

Top 10 Tumbler Manufacturers in China (2025 Updated List)

Many factory lists repeat marketing messages. I want to give a neutral and useful overview.

The top factories include Haers, Everich, KingStar, Cayi, Sibottle, Golmate, Maxlink, Innoadir, Auspace, and Fuguang. They differ in production capacity, ODM capability, and pricing strength.

Detailed Comparison

| Manufacturer | Strength | MOQ | Typical Price | Certifications |

|---|---|---|---|---|

| Haers | Advanced vacuum technology and large scale | 1000 | $2.50–$4.00 | FDA/LFGB |

| Everich | Eco design and recycled steel options | 500 | $2.20–$3.50 | BSCI/ISO |

| KingStar | Deep customization and lid systems | 800 | $2.30–$3.80 | SGS |

| Cayi | Wine tumblers and strong export ability | 1000 | $2.40–$3.90 | FDA |

| Sibottle | Fast ODM, competitive price, quick lead time | 1000 | $2.10–$3.20 | LFGB/FDA/BSCI |

| Golmate | Premium finish and EU focus | 500 | $2.50–$4.10 | ISO 14001 |

| Maxlink | Smart tumblers and creative development | 500 | $2.60–$3.70 | CE |

| Innoadir | Fashion prints and ODM catalog | 600 | $2.30–$3.60 | BSCI |

| Auspace | Full OEM and wide range | 1000 | $2.40–$3.90 | FDA |

| Fuguang | High volume and competitive basic models | 2000 | $1.90–$3.00 | SGS |

Haers leads in vacuum science and scale. Everich leads in eco options. KingStar focuses on advanced lids. Cayi performs well in wine markets. Sibottle provides fast ODM services and competitive cost for branding projects. Golmate is strong in premium finishing. Maxlink pushes smart technology. Innoadir targets modern styles. Auspace supports OEM projects. Fuguang suits high-volume and budget products.

Every manufacturer fits a different buyer profile, so your choice must match your market, price goals, and customization needs.

MOQ, Pricing, and Cost Structure Explained?

Many buyers expect promotional prices at low quantities. This causes confusion when quotations arrive.

Typical tumbler costs are $2.10–$4.00 at 1000 pieces. Prices drop 10–20% when ordering 5000–10000 pieces. Custom molds cost additional money.

Approximate Price Guide

| Quantity | Expected Price |

|---|---|

| 1000 units | $2.10–$4.00 |

| 5000 units | $1.80–$3.60 |

| 10000 units | $1.60–$3.20 |

ODM designs reduce tooling cost. Many buyers choose ODM instead of creating new molds.

How Long Does Production Actually Take?

Many factory websites show short delivery times. This creates wrong expectations.

Typical production needs 25–30 days. Peak seasons add 10–15 days. Custom colors and printing also add days.

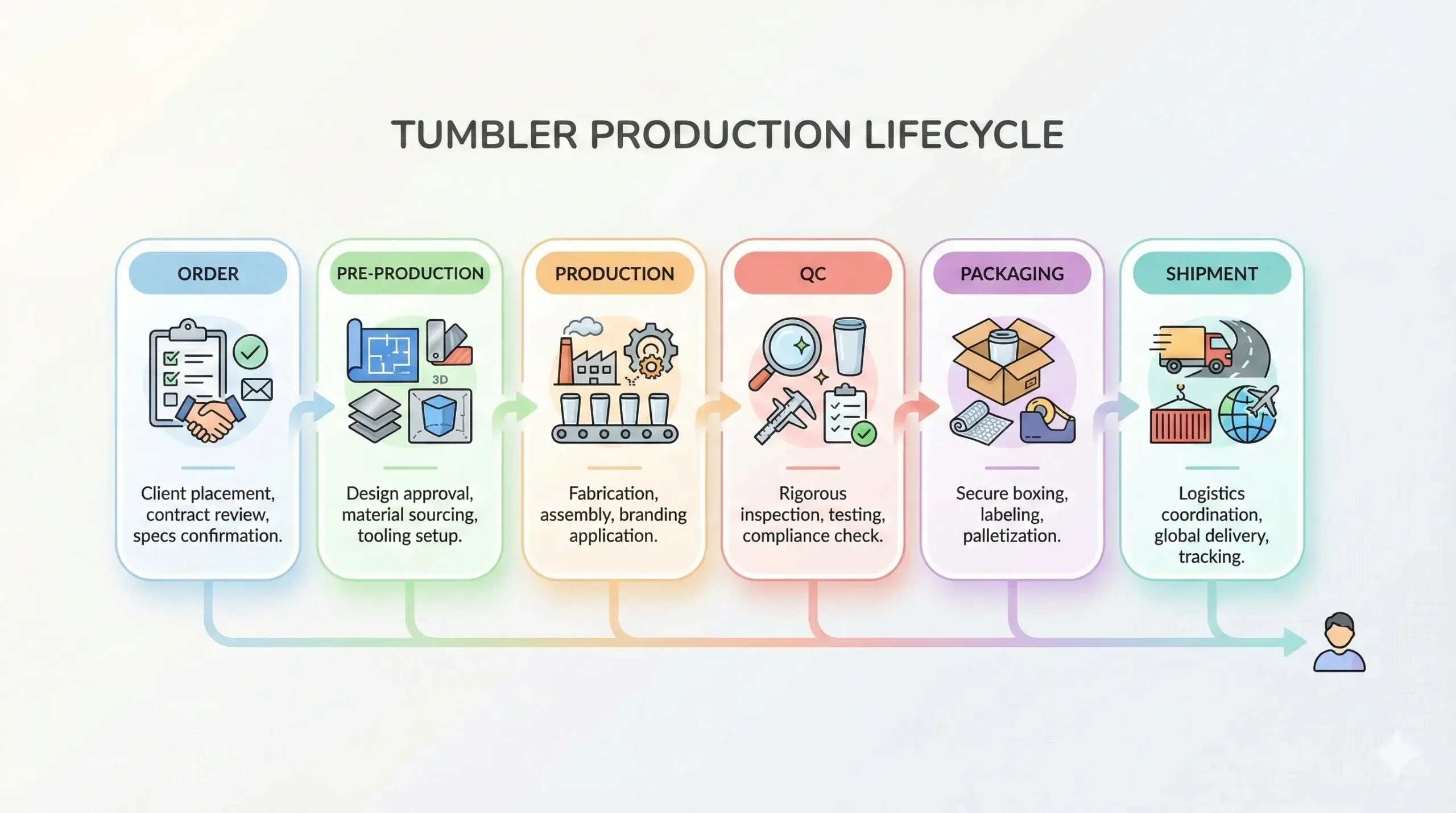

Timeline Steps

- Order and payment

- Pre-production

- Production

- QC and testing

- Packaging

- Shipment

Q3 and Q4 are peak seasons for holiday products. I always plan more time for these months.

FDA vs LFGB – Which Matters More?

Many buyers believe FDA is enough for all markets.

FDA covers US food safety. LFGB is stricter and needed for Germany and many EU markets.

Simple Explanation

| Standard | Region | Strictness |

|---|---|---|

| FDA | USA | Medium |

| LFGB | Europe | High |

FDA food contact regulations are outlined in 21 CFR Parts 170-1994, covering substances that may contact food. LFGB tests chemical migration very strictly5, including sensory evaluation for odor and taste transfer, so I suggest LFGB for EU projects.

Does Vacuum Insulation Work Long Term?

Many buyers think insulation performance always stays the same.

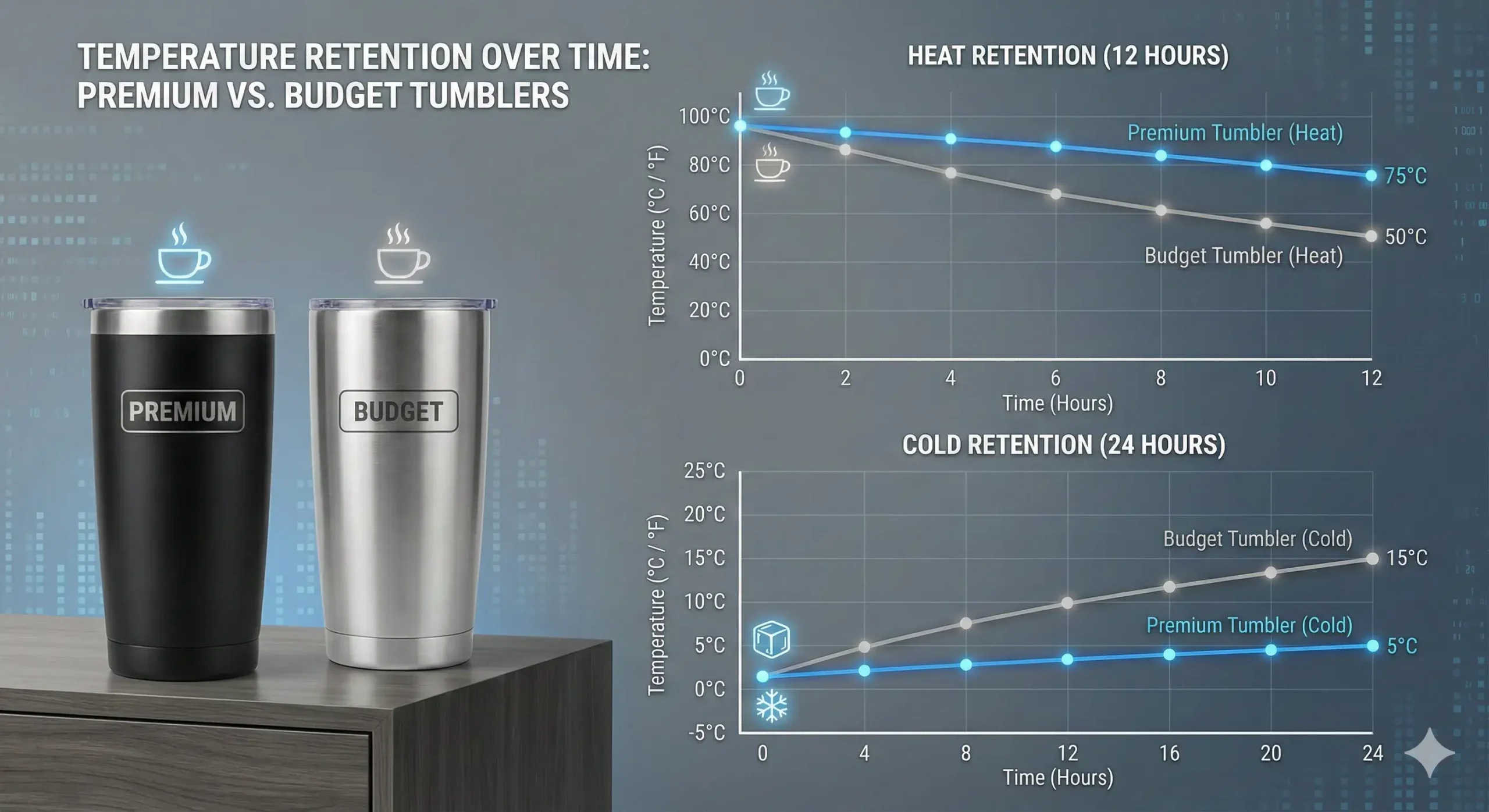

Vacuum performance decreases over time due to temperature change and physical handling. Premium factories test insulation long after production, not only at the beginning.

Vacuum insulation technology works by creating a near-vacuum between double walls6, which eliminates heat transfer through conduction and convection. Premium tumblers keep heat up to 12 hours and cold up to 24 hours. Budget products lose performance faster when used outdoors or in hot places.

Smart Tumblers: Real Market or Trend?

Some buyers expect smart tumblers to replace standard models, but the real market is small.

Smart tumblers are less than 3% of the market. They include temperature displays or hydration reminders, but they cost more and require batteries.

Smart water bottles feature hydration tracking, LED temperature displays, and app connectivity7 to help users monitor intake. I see them mainly in gifts or promotional campaigns instead of high-volume use.

China vs Malaysia vs Thailand Production Shifts?

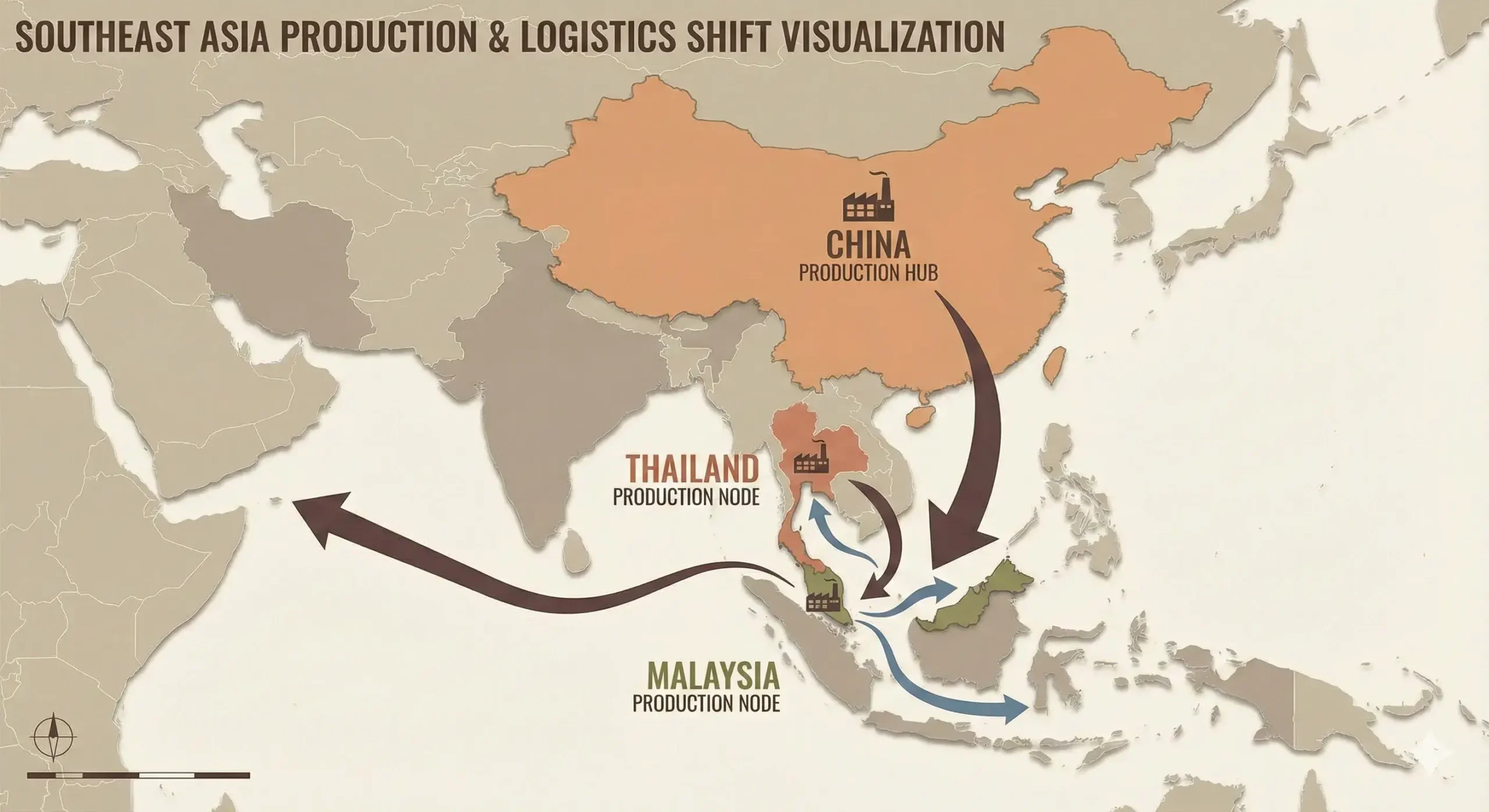

Many buyers think China is the only production option. This limits flexibility.

Some Chinese manufacturers now use Malaysia and Thailand factories to reduce tariffs and shorten delivery time for certain regions.

Regional Comparison

| Region | Advantage | Best Use |

|---|---|---|

| China | Capacity and speed | Main production |

| Malaysia | Tariff benefits | US markets |

| Thailand | Better logistics to ASEAN | Regional supply |

I see more factories planning ASEAN expansion because of global tariffs and logistics. Manufacturing investment is increasingly shifting to Vietnam, Thailand, Malaysia, and Indonesia8 as companies adopt "China-plus-one" sourcing strategies. In the future, large brands may source from multiple countries to control cost and shipping time.

Conclusion

I explained quality differences, materials, pricing, certifications and regional options. Contact me if you want ODM suggestions and factory comparison for your project.

TEMPLATE_END

-

ZEISS provides a technical overview of deep drawing as a forming technology regulated by DIN 8584, explaining how this tensile compression process creates metallic hollow bodies from flat sheet blanks. ↩

-

Wikipedia's comprehensive entry on hydroforming explains how this cost-effective metal shaping process uses high-pressure hydraulic fluid to form complex shapes, widely used in automotive and bicycle frame manufacturing. ↩

-

AZO Materials offers a detailed scientific comparison of 304 and 316 stainless steel food-grade properties, explaining how molybdenum content in 316L enhances corrosion resistance in chloride-rich environments. ↩

-

The FDA's official guidance on determining regulatory status of food contact materials explains compliance pathways under 21 CFR, including regulations for indirect food additives and GRAS substances. ↩

-

TÜV Rheinland's LFGB testing service page details the German food contact certification requirements based on EC No. 1935/2004 framework, including migration testing and chemical analysis protocols. ↩

-

Explain That Stuff provides an accessible scientific explanation of how vacuum flask insulation works by eliminating conduction, convection, and reducing radiation through reflective coatings. ↩

-

HidrateSpark's smart water bottle platform demonstrates current smart hydration technology capabilities including patented SipSense tracking, app integration, and customizable reminder features. ↩

-

Asia Society Policy Institute analyzes how ASEAN has emerged as a key manufacturing hub amid US-China trade tensions, with Chinese companies increasingly establishing production facilities in Thailand, Malaysia, and Vietnam. ↩