Finding a reliable Chinese water bottle supplier is not easy. Many online lists are biased or outdated. I collected verified data and factory insights to reveal the Top 20 real manufacturers in 2025.

China produces about 60% of global stainless-steel drinkware1. The top 20 Chinese water bottle manufacturers in 2025 combine certified quality, strong OEM experience, and stable export performance.

I'll show you who leads the market, what makes them stand out, and how they shape the industry's global trends.

Who Tops the List: The Leading 5 Chinese Water Bottle Producers?

Many factories claim to be "top-ranked," but only a few have the scale, innovation, and export records to prove it.

The five leading water bottle manufacturers in China for 2025 are Haers, Everich, KingStar, Golmate, and Auland. They represent the highest standards in production capacity, compliance, and international partnerships.

Top 5 Water Bottle Manufacturers in China 2025

| Rank | Manufacturer | Location | MOQ | Certifications | Key Strengths | Annual Output |

|---|---|---|---|---|---|---|

| 1 | Haers | Yongkang, Zhejiang | 3,000 | FDA, LFGB, ISO9001 | Smart insulation tech, global OEMs | 5M+ units |

| 2 | Everich | Yongkang, Zhejiang | 1,000 | FDA, LFGB, BSCI | Recycled materials, 20+ years experience | 10M+ units |

| 3 | KingStar | Yongkang, Zhejiang | 1,500 | FDA, LFGB, BSCI | 900+ employees, advanced automation | 8M+ units |

| 4 | Golmate | Guangzhou, Guangdong | 500 | FDA, LFGB | Mixed stainless/plastic expertise | 4M+ units |

| 5 | Auland | Zhejiang | 1,500 | FDA, LFGB | Vacuum tech, consistent EU exports | 6M+ units |

Most top players are located in Yongkang's vacuum flask manufacturing hub2, often called the "Vacuum Capital of China," thanks to its dense manufacturing ecosystem and shared supply chain for lids, coatings, and molds.

What Are the Mid-Tier Players Offering Unique Specialties?

These mid-tier manufacturers bridge mass production and niche innovation.

Sibottle, Koodee, LaiKoe, JIURUI, and Yongkang Funansheng stand out for their focus on customized ODM/OEM solutions, unique materials, and flexible order terms.

Mid-Tier Innovators and Their Niche Focus

| Manufacturer | Core Specialty | MOQ | Key Market | Distinguishing Feature |

|---|---|---|---|---|

| Sibottle | Trending stainless-steel drinkware OEM/ODM | 1,000 | North America & Europe | Wide customization (logo, color, lid, packaging), fast delivery |

| Koodee | Eco-friendly variants | 2,000 | North America | Bamboo-lid designs |

| LaiKoe (Reaching Group) | Youth-focused drinkware | 1,000 | Japan/EU | 10+ new designs yearly |

| JIURUI Houseware | Glass-stainless hybrids | 1,000 | Europe | Dual-layer designs for cafés |

| Yongkang Funansheng | Low-cost OEM | 500 | Asia | Competitive pricing, wide plastic range |

"Customization, not price, is what separates mid-tier winners in China's 2025 drinkware market." — Trade Analyst, 2025

Sibottle specializes in trend-driven designs that follow global consumer preferences. With 1,000-piece MOQ, full OEM/ODM support, and fast production turnaround, it's an ideal partner for B2B clients seeking flexibility without compromising quality.

How Do Emerging Manufacturers Stack Up in Innovation?

Innovation has become the main growth driver in China's water bottle industry.

Yisure, Zhejiang Cayi, ECO Drinkware, Safeshine, and Chengpeng lead the new generation with modular designs, smart features, and eco materials.

Emerging Manufacturers to Watch

| Manufacturer | Innovation Type | Notable Features | Target Market |

|---|---|---|---|

| Ningbo Yisure | Smart bottles | App tracking lids, modular bases | Smart lifestyle brands |

| Zhejiang Cayi | Vacuum efficiency | Lower-cost smart thermos tech | B2C export brands |

| ECO Drinkware | Sustainability | Bamboo accents, post-consumer materials | Eco retailers |

| Safeshine (Ningbo) | Leak-proof sports lids | Precision seals for sports bottles | Outdoor brands |

| Chengpeng (Jinhua) | Large-scale OEM | 75,000 m² plant, full CNC tooling | Asia/EU OEMs |

Why Innovation Matters

Buyers increasingly seek functional differentiation—smart hydration reminders, double insulation, or sustainable steel blends. These innovations not only justify higher pricing but also improve brand image in premium markets.

Emerging factories use CNC automation and AI quality checks, reducing defect rates by 20%. They also comply with EU REACH and RoHS standards, signaling the shift toward smarter, cleaner manufacturing.

What Key Factors Should You Consider When Choosing a Supplier?

Every importer faces the same question: how do I select a trustworthy manufacturer?

Reliable suppliers typically have transparent audits, stable MOQs, and clear certification records. Cost alone should never be the deciding factor.

Supplier Vetting Checklist

| Factor | Ideal Range or Standard | Why It Matters |

|---|---|---|

| MOQ | 500–5,000 units | Balances flexibility and efficiency |

| Price (stainless) | $1–6 per unit | Reflects grade, finish, and volume |

| Certifications | FDA, LFGB, BSCI3 | Ensures compliance and social accountability |

| Lead Time | 4–6 weeks | Standard for bulk OEM |

| Samples | $50–100 refundable | Validates quality before bulk order |

| Tariffs/Shipping | +15% (avg.) | Affects landed cost, plan margins |

Warning: Some factories advertise fake certifications or use low-grade stainless steel (201 instead of 304)4. Always request SGS test reports or third-party inspection before confirming mass production.

"Never skip material testing — one faulty batch can cost more than any inspection fee." — Sourcing Manager, 2025

How Has the Chinese Water Bottle Industry Evolved in 2025?

The 2025 landscape reflects both sustainability mandates and global market shifts.

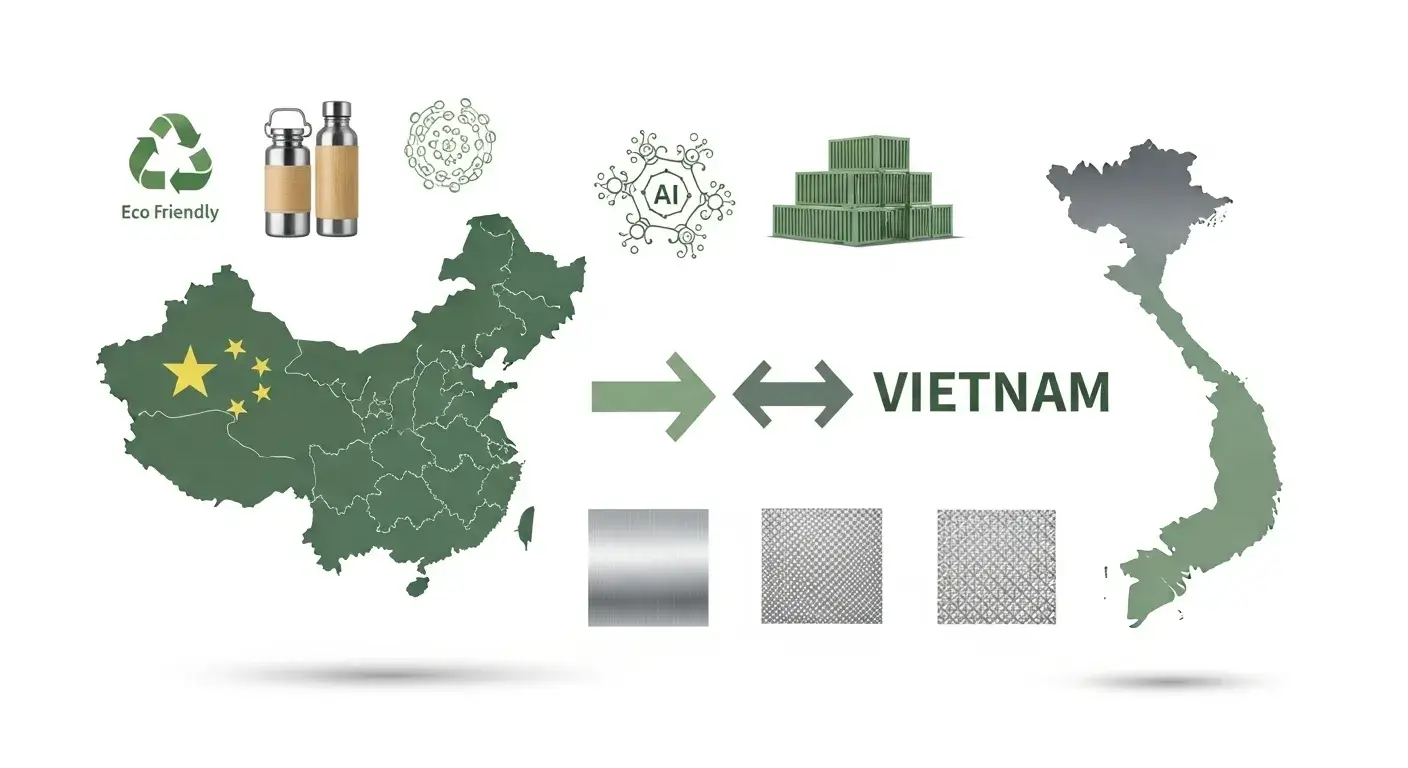

China's water bottle exports grew 15% to reach 1.5 billion units in 2024, despite tariff pressures and supply chain relocation to Vietnam5.

Market Trends

- Vietnam Shift: Around 10% of production moved to Vietnam to offset U.S. tariffs (up to 25%).

- Zhejiang Dominance: Still produces 70% of global stainless bottles.

- Sustainability Push: 30% recycled material mandate by 2026; 95% of bottles are now BPA-free6.

- Tech Integration: UV sterilization lids, leak-proof sensors, and AI-assisted quality control.

Green Manufacturing

Factories like Everich and Sibottle now use post-consumer stainless steel to cut carbon emissions by 25%. BSCI audits improved 30% compliance rates versus 2023.

Tech-Enabled Customization

AI design systems predict consumer trends, enabling brands to test 3D bottle models before tooling. This digital approach reduces mold waste and shortens sampling cycles to just 72 hours.

Conclusion

China remains the core of global drinkware manufacturing. Leading brands combine certified quality, sustainable sourcing, and innovation. Partnering with the right OEM ensures steady growth and long-term brand trust.

-

Discover verified market data showing China's dominant position in global drinkware production and how stainless steel demand is reshaping the industry through 2034. ↩

-

Learn why China's "Vacuum Capital" concentrates 80% of drinkware production and how its supply chain ecosystem reduces your sourcing costs by 15-25%. ↩

-

Understand the critical testing requirements and regulatory differences between U.S. FDA and European LFGB standards to avoid costly customs rejections and product recalls. ↩

-

See the exact chemical composition differences between food-grade 304 and inferior 201 steel that could cause your bottles to rust or leach harmful manganese. ↩

-

Get the latest analysis on how 34-50% tariff increases are forcing manufacturers to relocate and what this means for your 2025 procurement pricing strategy. ↩

-

Read Columbia University's health research explaining why BPA exposure from plastic bottles disrupts hormones and why stainless steel is the safer long-term choice. ↩